Credit union Midtown Manhattan

Brooklyn Cooperative Federal Credit Union

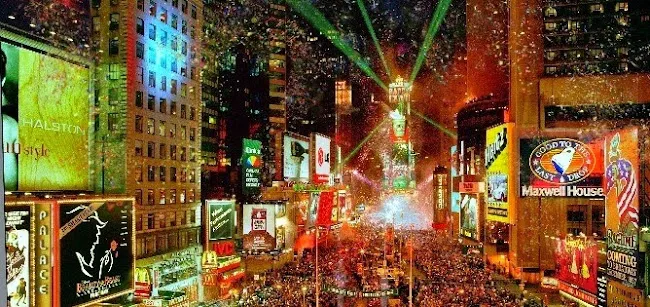

Midtown Manhattan

1474 Myrtle Ave Brooklyn, NY 11237 United States

NY Bravest Federal Credit Union

Midtown Manhattan

204 E 23rd St 3rd Floor of the UFA Building New York, NY 10010 United States

Credit Union in Midtown Manhattan

Midtown Manhattan is not just a bustling hub of culture, shopping, and entertainment; it also serves as a prime location for financial institutions, particularly credit unions. These member-owned financial cooperatives offer an array of banking services that can often be more favorable than traditional banks.

One of the key advantages of credit unions is their community-oriented approach. Unlike traditional banks that prioritize profit, credit unions focus on serving their members. This means that individuals who join a credit union can expect lower fees, higher savings rates, and more favorable loan terms. For residents and workers in Midtown Manhattan, a credit union can be a smart financial choice.

In addition to these benefits, credit unions in Midtown Manhattan often provide personalized services. Members can enjoy one-on-one consultations that help tailor financial solutions to their specific needs. Whether it’s a personal loan, mortgage, or credit card, the staff at these institutions are dedicated to helping their members achieve their financial goals.

Furthermore, credit unions typically offer a range of services that include checking and savings accounts, auto loans, and even investment advice. This comprehensive approach to banking means that members can manage all their financial needs under one roof, making it convenient for busy individuals in the heart of Manhattan.

Another significant advantage is the focus on financial education. Many credit unions in Midtown Manhattan offer workshops and resources that educate members about budgeting, saving, and investing. This emphasis on financial literacy is crucial in today’s economy, empowering individuals to make informed decisions about their finances.

For those considering becoming a member of a credit union, it’s important to understand the membership requirements. Most credit unions have specific eligibility criteria based on factors such as location, employer, or community affiliation. However, many are open to anyone who lives or works in the area, making it accessible for most residents of Midtown Manhattan.

To explore the options available in the area, visit www.manhattan-nyc.com. Here, you can find a list of credit unions in Midtown Manhattan, compare their services, and determine which one best suits your financial needs.

In conclusion, credit unions in Midtown Manhattan offer a unique alternative to traditional banking. With their focus on community, personalized service, and commitment to financial education, they stand out as a valuable resource for individuals looking to improve their financial well-being.