Credit counseling service Uptown Manhattan

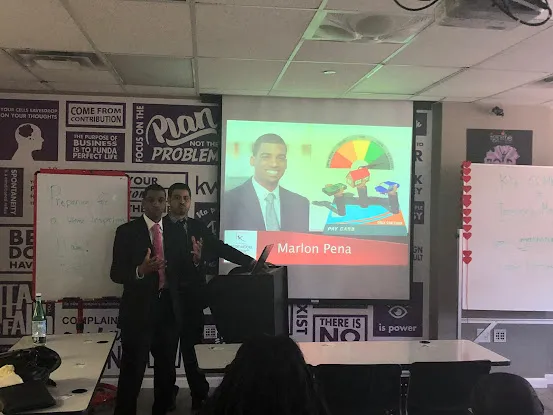

Apex Credit Fix

Downtown Manhattan

111 Town Square Pl Suite 1203 Jersey City, NJ 07310 United States

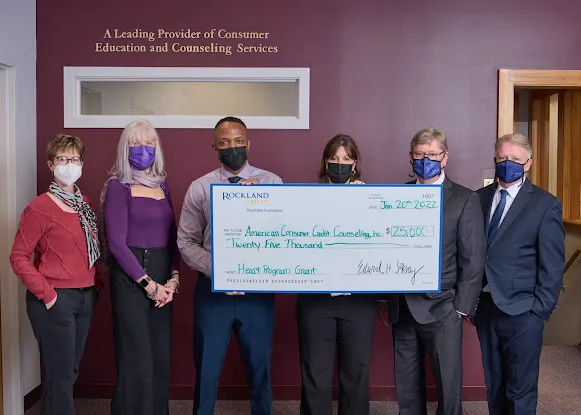

American Consumer Credit Counseling, Inc.

Downtown Manhattan

221 River St 9th floor Hoboken, NJ 07030 United States

American Consumer Credit Counseling, Inc.

Downtown Manhattan

300 Cadman Plz W 12th Floor Brooklyn, NY 11201 United States

ULTRA CREDIT SOLUTIONS-CREDIT REPAIR

Midtown Manhattan

3716 73rd St Suite. 302-B Jackson Heights, NY 11372 United States

ECG Debt Settlement & Credit Repair

Downtown Manhattan

30-97 Steinway St Suite 205 Astoria, NY 11103 United States

Core Multiservices-Credit Repair

Downtown Manhattan

37-42 72nd St Jackson Heights, NY 11372 United States

Credit Counseling Service in Uptown Manhattan

In the vibrant heart of Uptown Manhattan, residents face various financial challenges that can be overwhelming. Fortunately, credit counseling services play a crucial role in helping individuals regain control over their financial lives. These services provide essential guidance and support to those struggling with debt, budgeting, and overall financial management.

Understanding Credit Counseling

Credit counseling is a service designed to assist individuals in understanding and managing their finances better. It involves working with certified counselors who evaluate your financial situation and offer personalized advice. This service is particularly beneficial for those who find themselves in precarious financial situations, struggling to keep up with bills or facing mounting debt.

Why Choose Credit Counseling in Uptown Manhattan?

Uptown Manhattan is a bustling area filled with diverse communities and economic backgrounds. Many residents may find themselves in need of professional assistance to navigate the complexities of personal finance. Here are several reasons why credit counseling is an excellent choice:

- Personalized Financial Plans: Counselors work closely with clients to develop tailored financial plans that address specific needs and goals.

- Debt Management: These services help create strategies to manage and reduce debt, providing clients with tools to negotiate with creditors effectively.

- Educational Resources: Credit counseling agencies offer workshops and resources to educate clients about budgeting, saving, and responsible credit use.

Accessing Credit Counseling Services

Residents of Uptown Manhattan can easily access credit counseling services through various local agencies. Many organizations offer free initial consultations, allowing individuals to assess their financial situation without any upfront costs. When selecting a credit counseling service, it’s vital to choose a reputable agency that is accredited and has positive reviews. Look for organizations that are members of national foundations, as this often indicates a commitment to ethical practices and client education.

The Impact of Credit Counseling

Engaging with credit counseling services can lead to significant improvements in financial well-being. Many clients report feeling more empowered and informed about their financial choices after receiving guidance. With the right support, individuals can break free from the cycle of debt and build a sustainable financial future.

Conclusion

In Uptown Manhattan, credit counseling services offer a vital lifeline for residents facing financial difficulties. By providing education, support, and personalized plans, these services help individuals regain their financial footing and move towards a more secure future. For more information on local credit counseling options, visit www.manhattan-nyc.com.