Credit counseling service Downtown Manhattan

Apex Credit Fix

Downtown Manhattan

111 Town Square Pl Suite 1203 Jersey City, NJ 07310 United States

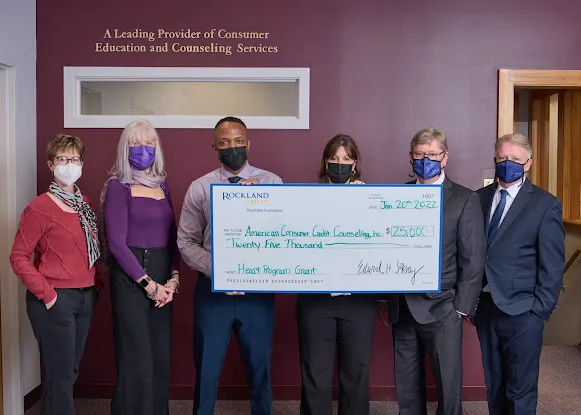

American Consumer Credit Counseling, Inc.

Downtown Manhattan

221 River St 9th floor Hoboken, NJ 07030 United States

American Consumer Credit Counseling, Inc.

Downtown Manhattan

300 Cadman Plz W 12th Floor Brooklyn, NY 11201 United States

USA Credit Repair

Downtown Manhattan

ECG Debt Settlement & Credit Repair

Downtown Manhattan

30-97 Steinway St Suite 205 Astoria, NY 11103 United States

Credit Counseling Service in Downtown Manhattan

In the bustling heart of Downtown Manhattan, individuals and families often face financial challenges that can feel overwhelming. Whether it's due to unexpected expenses, job loss, or mounting debt, finding the right support is crucial. This is where credit counseling services come into play, offering valuable assistance to those in need.

Credit counseling services in Downtown Manhattan are designed to help consumers understand their financial situations and develop effective budgets. These services are typically provided by non-profit organizations that prioritize the well-being of their clients. They offer a range of programs, including debt management plans, financial education workshops, and personalized counseling sessions.

One of the key benefits of utilizing credit counseling services is the opportunity for personalized guidance. A certified credit counselor will work closely with clients to analyze their financial status, including income, expenses, and debts. This comprehensive assessment allows the counselor to create a tailored action plan that addresses each client's unique circumstances.

Moreover, these services can provide essential tools and resources to help clients regain control of their finances. For instance, many credit counseling agencies in Downtown Manhattan offer financial literacy programs that teach individuals how to manage their money more effectively. By understanding budgeting, saving, and responsible credit use, clients can work towards achieving long-term financial stability.

Additionally, credit counseling can significantly impact an individual's credit score. By enrolling in a debt management plan, clients can often negotiate lower interest rates with creditors and consolidate their debts into a single monthly payment. This not only simplifies the repayment process but can also lead to a gradual improvement in credit scores over time.

For those living in Downtown Manhattan, accessing credit counseling services is easy and convenient. Many organizations offer in-person consultations, as well as virtual sessions, ensuring that help is available to everyone, regardless of their circumstances. With the right support, individuals can navigate their financial challenges and emerge stronger and more informed.

In conclusion, credit counseling services in Downtown Manhattan provide an invaluable resource for those seeking to improve their financial situation. By taking advantage of these services, individuals can gain the knowledge and support needed to make informed decisions and pave the way for a brighter financial future. For more information about available services, visit www.manhattan-nyc.com.